As a small business owner, I understand how daunting it can be to navigate the world of tax credits. The Tax Credit Eligibility Calculator is a tool designed to simplify this process, helping you discover what credits you qualify for. These credits can significantly reduce your tax liability and improve your cash flow, but understanding eligibility requirements often feels like deciphering a complex code. That’s why I’m excited to introduce you to this calculator, which makes it easier for small businesses to maximize their savings.

Understanding Complex Regulations and Compliance

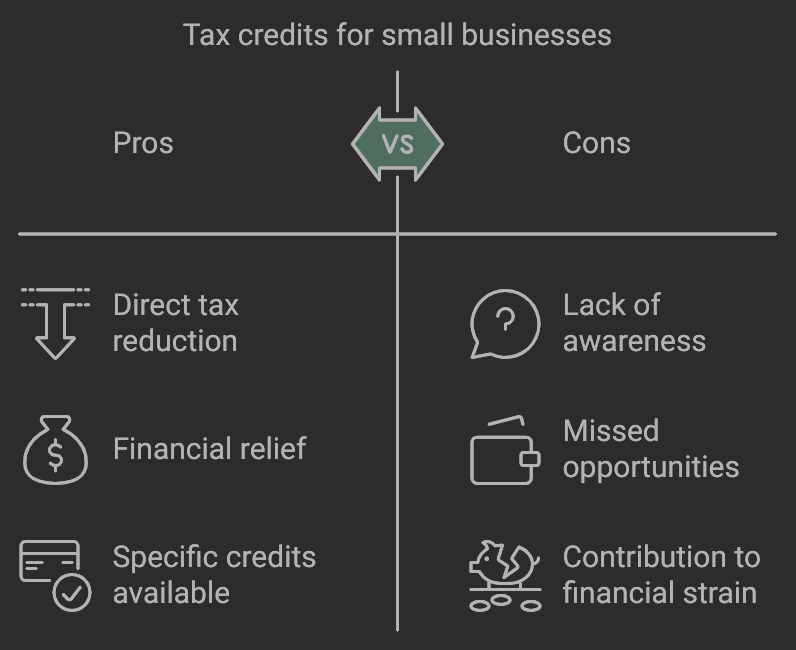

Tax credits are a fantastic way for small businesses to save money. Tax credits lower your tax liability dollar for dollar, in contrast to deductions that lower your taxable income. For example, if you qualify for a $5,000 tax credit, your tax liability decreases by that full amount! According to the IRS, various types of tax credits are available specifically for small businesses, including the Research & Development (R&D) Tax Credit and the Work Opportunity Tax Credit (WOTC).

However, a significant percentage of small businesses—approximately 60%—are unaware of their eligibility for various tax credits. This lack of knowledge can lead to missed opportunities for financial relief and may contribute to financial strain. Studies indicate that 30% of small businesses cite cash flow issues as a primary reason for failure.

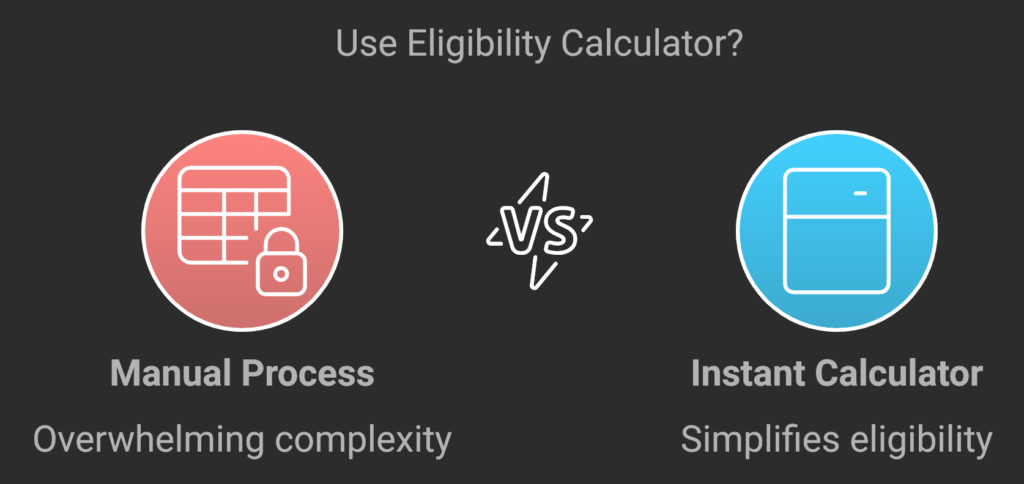

The Need for Tax Credit Eligibility Calculator

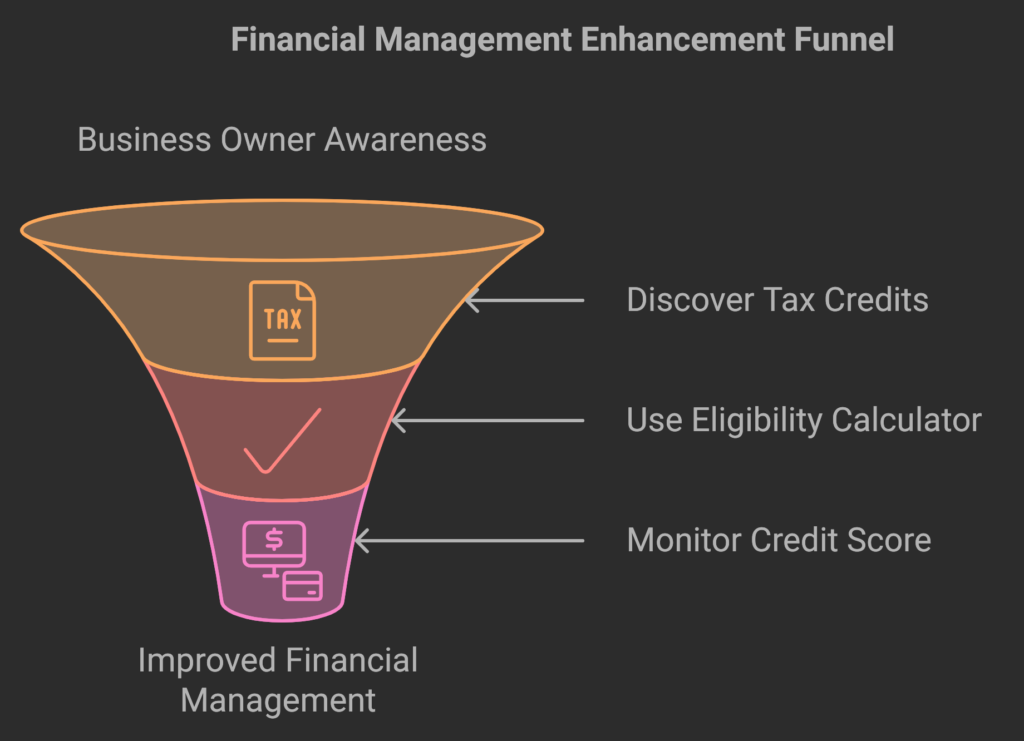

Determining eligibility for these credits can be overwhelming. With constantly changing regulations and complex requirements, many small business owners miss out on potential savings simply because they don’t know where to start. That’s where the Instant Tax Credit Eligibility Calculator comes in—it takes the guesswork out of the equation.

How the Instant Tax Credit Eligibility Calculator Works

Using the calculator is straightforward:

- Input Your Information: Start by entering relevant details about your business, such as income and expenses.

- Review Eligibility Criteria: The calculator will analyze your information against current eligibility criteria.

- Receive Instant Feedback: You’ll get immediate results showing potential tax credits you may qualify for.

This tool is designed with user privacy in mind—your information is not stored or shared, ensuring a secure experience.

Benefits of Using the Calculator

- Time-Saving: Instead of sifting through mountains of paperwork or spending hours researching eligibility, you can quickly assess your situation with just a few clicks.

- Informed Decision-Making: Understanding what tax credits you can claim empowers you to make better financial decisions for your business.

- Proactive Compliance: Staying informed about eligibility helps ensure that you remain compliant with IRS regulations.

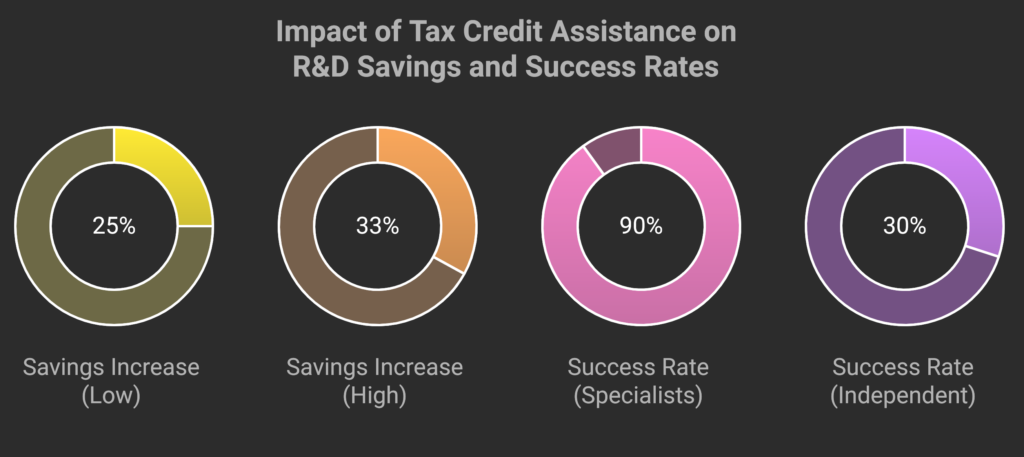

I’ve seen firsthand how powerful this calculator can be. For instance, one small business owner I know used it to discover they qualified for several tax credits they hadn’t even considered. By utilizing these credits, they were able to reduce their tax bill significantly, freeing up cash flow that was crucial for their operations. Moreover, businesses that actively seek assistance with their tax credit claims have reported an average increase in savings of 25-33% on their eligible R&D expenditures. Research shows that small businesses working with R&D tax credit specialists have a 90% success rate in their claims compared to only 30% for those who attempt to navigate the process independently. This highlights the critical role that expertise plays in maximizing potential savings and ensuring compliance with complex regulations.

Frequently Asked Questions (FAQs)

Q: What types of tax credits are available for small businesses?

A: Small businesses can access various tax credits such as the R&D Tax Credit and Work Opportunity Tax Credit (WOTC). Go to the IRS website. to learn more.

Q: How does the Instant Tax Credit Eligibility Calculator work?

A: The calculator allows you to input your business information and provides instant feedback on potential tax credits based on current eligibility criteria.

Q: When using the calculator, is my data secure?

A: Yes! Your information is not stored or shared when using the calculator.

Promoting Financial Health

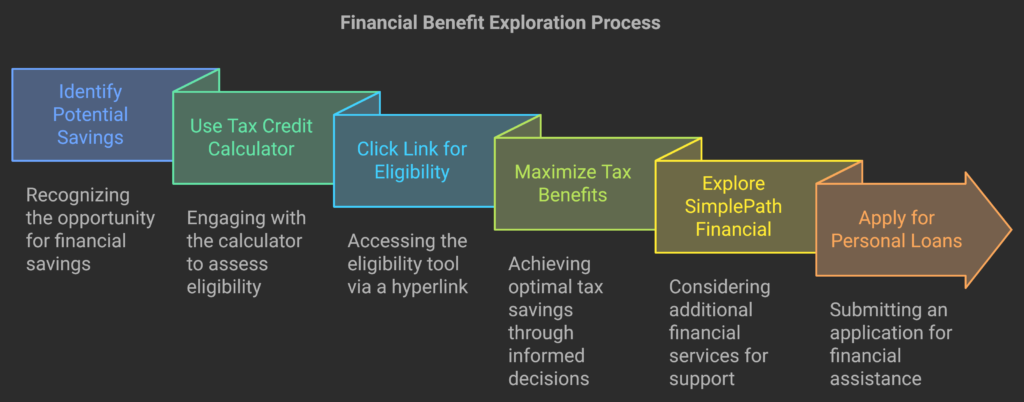

Don’t miss out on potential savings! I encourage you to try the Instant Tax Credit Eligibility Calculator now. To see what you are eligible for, click here! By taking this step, you’re on your way to maximizing your tax benefits and improving your financial situation. Plus, if you’re looking for additional support with managing cash flow or reducing interest rates on personal loans, check out SimplePath Financial. They offer personal loans with no upfront fees or obligations—just apply online or call them today!

Monitoring Your Credit Score

Understanding tax credit eligibility is crucial for maintaining your financial health. I highly recommend checking out CheckFree Score, where you can check your credit score and monitor all three bureaus for free! This service allows you to stay informed about your credit status without any cost, ensuring you’re always in control of your financial future. Don’t miss out on these valuable resources—Check Your Credit Score! and start your journey to improved money management right now!

Conclusion

Understanding tax credit eligibility is crucial for small businesses aiming to maximize their savings. The Instant Tax Credit Eligibility Calculator simplifies this process and makes it accessible for all business owners. By using this tool, you can uncover valuable opportunities that may significantly impact your bottom line. Additionally, monitoring your credit score is essential for maintaining your financial health. I highly recommend checking out CheckFree Score, where you can check your credit score and monitor all three bureaus for free! This service allows you to stay informed about your credit status without any cost, ensuring you’re always in control of your financial future. Don’t miss out on these valuable resources—Check Your Credit Score! and begin the process of improving your financial management right now! If you have any experiences or questions about tax credits or using the calculator, feel free to share them in the comments below. Let’s navigate this journey together and ensure we all take advantage of the resources available to us!

Related Insights: Explore More on Maximizing Your Business Finances

How to Boost Your Credit Score in 30 Days: A Complete Step-by-Step Guide

A key element of your financial well-being is your credit score. Whether you’re looking to secure a loan, obtain a better interest rate, or simply enhance your financial standing, improving your credit score can unlock numerous opportunities.

How to Maximize Your Business Tax Credits: Essential Tools and Resources You Need!

In today’s competitive landscape, understanding and maximizing your business tax credits can significantly enhance your financial health.

Small Business Tax Deductions Checklist 2024

Navigating the world of small business tax deductions can be overwhelming, especially with the complexities of tax laws.

Small Business Tax Deduction Cheat Sheet for 2024

Navigating the intricacies of small business tax deduction can be daunting for business owners, particularly when aiming to legally minimize tax liabilities.

Disclaimer: This blog post contains affiliate links, which means that if you click on one of the product links and make a purchase or take an action, I may receive a commission or compensation at no extra cost to you.

Leave a Reply