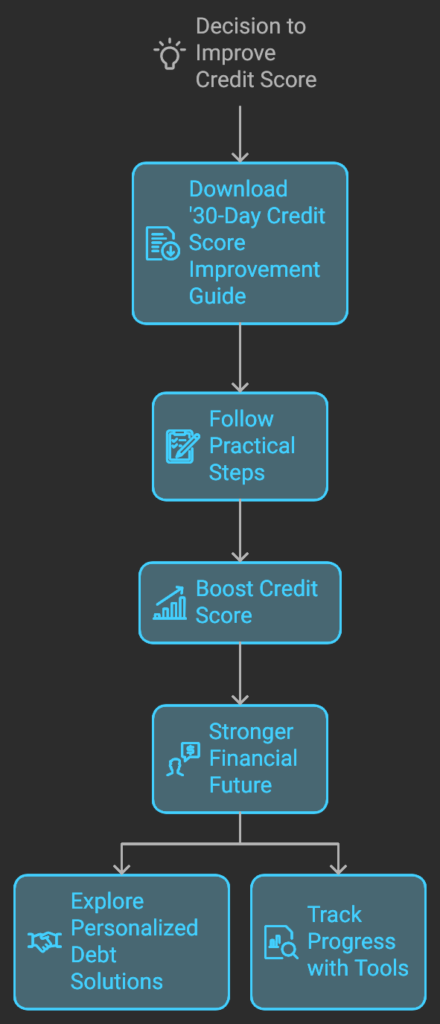

A key element of your financial well-being is your credit score. Whether you’re looking to secure a loan, obtain a better interest rate, or simply enhance your financial standing, improving your credit score can unlock numerous opportunities. So, how can you effectively boost your credit score in just 30 days? In this comprehensive guide, we will outline proven strategies to help you elevate your credit score quickly. Plus, be sure to download our free ’30-Day Credit Score Improvement Guide’ PDF for a detailed checklist and additional resources.

Week 1: Review Your Credit Report and Set Goals

Knowing where you stand right now is the first step to raising your credit score. A thorough review of your credit report will help you identify the factors affecting your score and set actionable goals.

1. Check Your Credit Report for Free

Visit AnnualCreditReport.com to obtain a free copy of your credit report from the three major bureaus: Experian, TransUnion, and Equifax. Check for any information that might be hurting your score, such as outdated or inaccurate information.

2. Understand the Factors Influencing Your Score

There are numerous important elements that affect your credit score:

- Payment History (35%): Ensure all bills are paid on time.

- Credit Utilization (30%): Keep credit card balances below 30% of your total available credit.

- Length of Credit History (15%): A longer credit history can positively impact your score.

- New Credit (10%): Each new application can temporarily lower your score.

- Types of Credit Used (10%): A diverse mix of credit accounts can benefit your score.

3. Use Credit Monitoring Tools

Utilize tools like CheckFree Score, Click Free Score, and CreditScoreIQ to gain insights into your credit report and receive alerts for any changes or suspicious activity. Regular monitoring keeps you informed and helps you stay on track. Tip: If you discover errors on your credit report, dispute them immediately with the relevant credit bureaus. You can quickly raise your score by fixing errors.

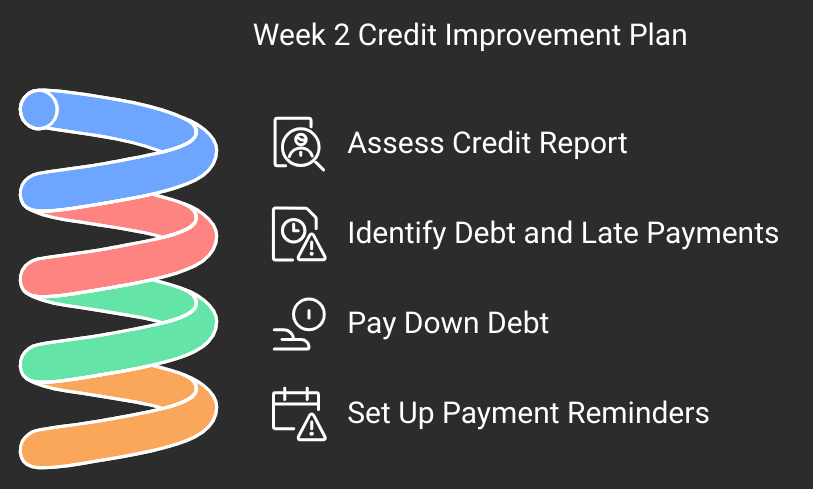

Week 2: Pay Down Debt and Set Up Payment Reminders

Once you’ve assessed your credit report, it’s time to tackle any existing debt and late payments.

1. Create a Debt Repayment Plan

List all of your debts first, along with the interest rates associated with each. You can use either the snowball method (paying off the smallest debts first) or the avalanche method (focusing on debts with the highest interest rates). Both strategies can effectively reduce your debt over time.

2. Consider Debt Consolidation

If you have multiple high-interest debts, consolidating them into a single lower-interest loan may be beneficial. SimplePath Financial offers solutions that make debt payments more manageable while potentially lowering overall interest costs.

3. Set Up Automatic Payments or Reminders

To avoid late payments that harm your credit score, set up automatic payments through your bank or use calendar reminders. Staying on top of payments is crucial for maintaining a healthy credit profile.

4. Negotiate Your Interest Rates

Never be afraid to contact your credit card companies in order to bargain for reduced interest rates. A solid payment history can give you leverage; reducing interest rates lowers the total amount you pay over time, making it easier to manage debt.

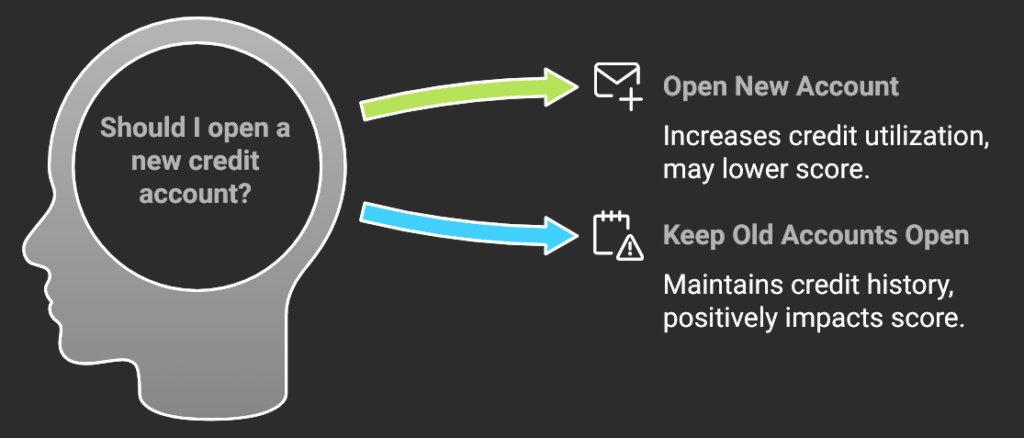

Week 3: Limit New Credit Applications and Keep Old Accounts Open

While it may be tempting to open new credit accounts, doing so can negatively impact your score. Here’s how to manage your existing credit wisely:

1. Minimize Hard Inquiries

Each time you apply for new credit, a hard inquiry is recorded on your report, which can temporarily decrease your score. Limit applications for new credit during this improvement period unless absolutely necessary.

2. Keep Your Credit Utilization Low

A credit usage ratio of less than 30% should be your goal. For example, if you have a total credit limit of $10,000, keep total balances below $3,000. Paying down existing balances will improve this ratio and subsequently enhance your score.

3. Maintain Old Credit Accounts

Longer credit history is positively correlated with older accounts. If you have old accounts with no balance, consider keeping them open; closing them can shorten your history and negatively impact your score.

4. Bonus Tip: Become an Authorized User

If possible, ask a family member or friend with good credit to add you as an authorized user on their account. Taking advantage of their solid payment track record can help you boost your score.

Week 4: Monitor Your Progress and Protect Your Credit

As you approach the end of this 30-day plan, it’s important to monitor the progress you’ve made and adjust strategies for long-term success.

1. Check Your Credit Score Again

Use monitoring tools like CreditScoreIQ to see how much you’ve improved over the past month. Celebrate small victories and set new goals for further enhancement.

2. Set Up Fraud Alerts or Credit Freezes if Necessary

If you notice suspicious activity or want extra protection, consider placing a fraud alert or freeze on your credit report. This precaution helps safeguard against identity theft.

3. Continue Using a Budgeting Tool

Apps like Mint or YNAB (You Need A Budget) can assist you in managing finances effectively and ensuring that you don’t revert to bad habits that could harm your credit.

Additional Resources

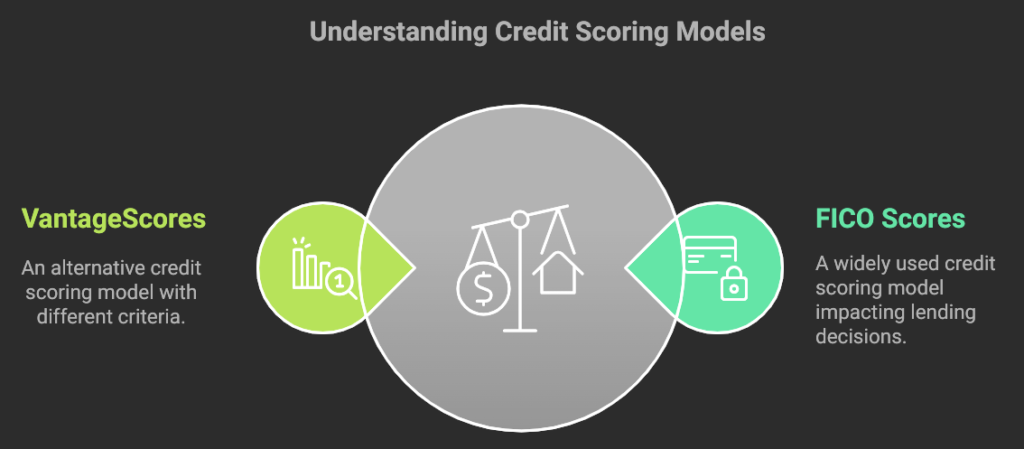

Understanding Different Credit Scoring Models

Did you know that there are variations between FICO scores and VantageScores? Understanding these differences can help manage expectations regarding how scores are calculated.

How to Dispute Credit Report Errors

Mistakes happen! Download our free template for disputing errors on your credit report to ensure it accurately reflects your financial history.

Essential Tools for Ongoing Credit Improvement

Utilize tools like CheckFree Score, CreditScoreIQ, and Credit Repair Magic to track and manage progress over time.

The Ultimate 30-Day Checklist for Credit Improvement

Here’s a recap of the essential steps to take over the next month:

- Obtain a free copy of your credit report.

- Identify errors and dispute inaccuracies.

- Set realistic goals for improving your score.

- Use monitoring tools for alerts.

- Create a debt repayment plan.

- Consider debt consolidation if necessary.

- Set up payment reminders or automate payments.

- Avoid applying for new credit.

- Keep utilization below 30%.

- Maintain old accounts open.

- Monitor progress weekly.

- Negotiate lower interest rates.

- Use budgeting apps effectively.

- Place fraud alerts or freezes as needed.

- Set new goals for the next month.

Conclusion

The process of raising your credit score doesn’t have to be too difficult! By following these practical steps, you can boost your score in just 30 days and pave the way for a stronger financial future. Download our free ’30-Day Credit Score Improvement Guide’ now and embark on the journey toward better credit today! For personalized debt solutions, consider exploring options with SimplePath Financial, and keep track of your progress using tools like CheckFree Score and CreditScoreIQ.Download the guide here!

Disclaimer: This post contains affiliate links. If you purchase through them, I may earn a commission at no extra cost to you.

Leave a Reply